“Unique aspects of Hefei’s approach includes aggressive efforts to woo high-tech companies and take direct ownership stakes, which is premised on that company making a significant investment in Hefei, followed by the government selling its stake at a later time.”

Summary: Local state as venture capitalist: the Rise of the “Hefei Model”

In 2015, China's Premier Li Keqiang visited his hometown of Hefei in Anhui to promote an ambitious vision for China to dominate industries of the future. The plan Made in China 2025 sparked anxiety in countries around the world, particularly in the U.S. where it was cited by officials in the Trump administration as justification for newly aggressive policies that have lead to U.S.-China decoupling. Anhui has long been a poor backwater in China—the term 安徽保姆 Anhui Baomu connotes the fact that many domestic helpers in China hailed from the largely rural province. In recent years the city of Hefei has undone this stereotype. And it has done so by implementing the Made in China 2025 vision for excelling in manufacturing in strategic sectors: semiconductors, EVs, and optoelectronics. In 20 years, Hefei’s GDP ranking shot from 80th to 20th in the country, its fiscal revenue increased 33 times, and its population increased from 4.38 million to more than 9.3 million, and its economic output has doubled to $140 bn1. How did the “Hefei model” achieve this?

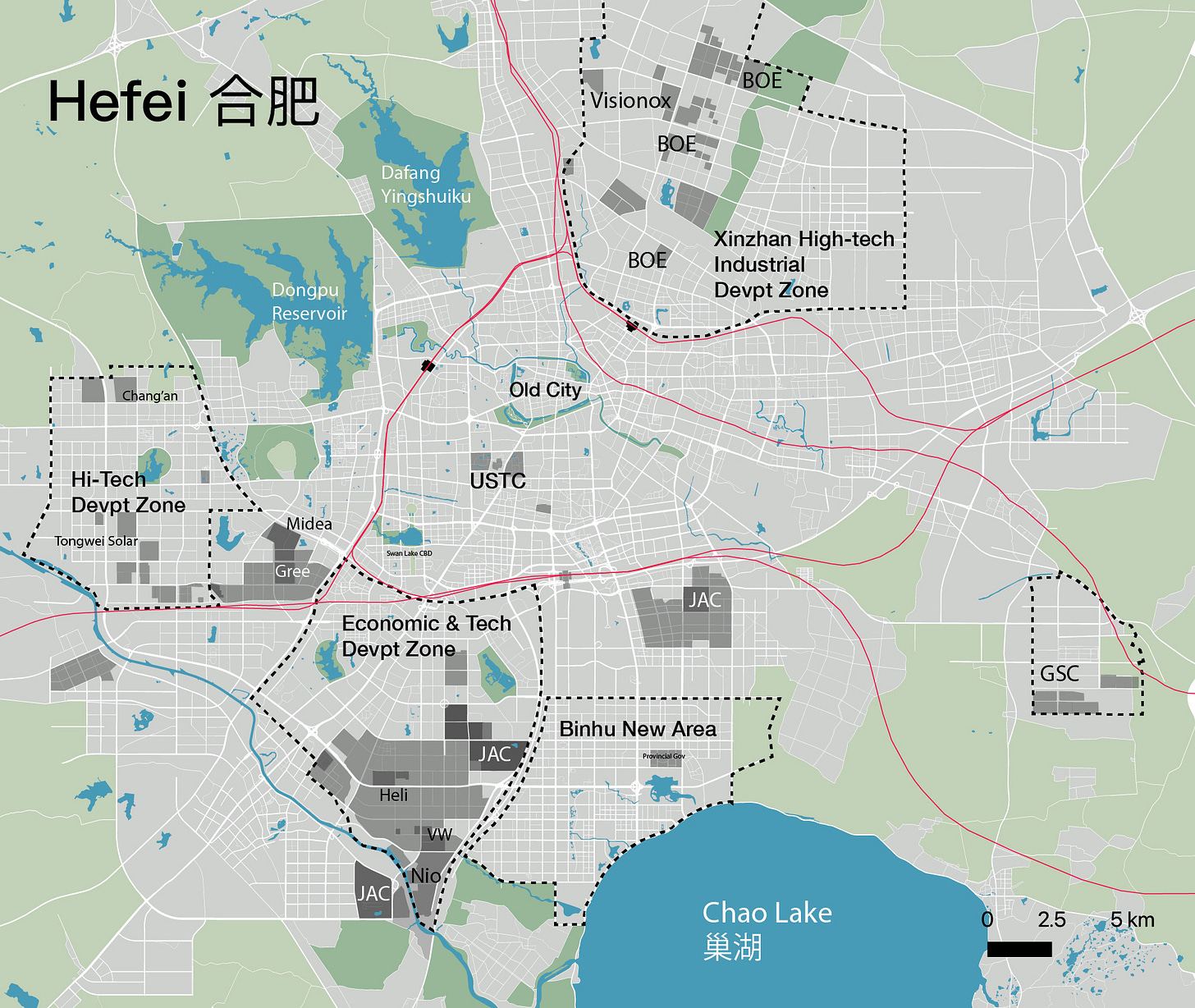

In 2024, the New York Times reported on the city, calling the Hefei model as “Using government money to buy newly issued shares in manufacturers and start-ups that need cash.”2 Xinhua (state owned media) defined the model in a more process-oriented way: “State capital is directly invested in leading enterprises of emerging industries that are viewed as strategically important but often considered by private investors as too risky or costly. The state capital gradually exits from these enterprises after their market prospects become clearer and they attract interest from non-government investors…State investment returns are then used to support more projects in the industry to cultivate a resilient industrial chain. A healthy industrial ecology is developed in this process, drawing more outside investment, technologies and talent to form a virtuous cycle.”3 But the Hefei model is a bit more complicated than these explanations suggests. Let’s take a deeper dive at the specific entities and their investment strategies. First (1.) I’ll explore the ecosystem of government entities and investment funds comprising the “Hefei model” followed by (2.) several cases in particular industries the city has concentrated on: LCD screens, electric vehicles, and DRAM memory chips. Within each case I look at: a.) institutional arrangements, as well as b.) spatial clustering of firms in industrial zones.

A state-led venture Ecosystem

There are three main state-owned investment and financing platforms : Hefei Construction Investment 合肥市建投集团, founded in 2006 which has the largest capital among the three and focuses on industrial infrastructure (as most LGFVs) as well as electric vehicles, tourism, & transportation. The Hefei Industrial Investment (合肥市产业投资控股) was started in 2015 focuses on emerging sectors like memory chips, while Hefei Xingtai 合肥兴泰 functions as a local financial holding platform and dates to 2002.4 There are around 12,000 of these LGFV entities in cities and other local governments around China. They can come in different flavors, but often feature something like “urban investment/construction company” 城市投资建设公司 in their name.5 So LGFV are by no means unique to Hefei, but they have primarily been associated with land and infrastructure development. Hefei’s main LGFV (Hefei Construction Investment Holding Group 合肥建投集团 or HFJT founded in 2006, is among the largest in China with total assets of 613.584 billion yuan. ($83 bn USD). Like other LGFVs, Hefei’s has also invested in infrastructure and construction projects such as new economic zones.6

What is unique about Hefei’s is that its LGFVs have moved beyond the traditional projects (like infrastructure) to take on the role of venture capitalist, investing in both mature and early-stage firms in strategic sectors. The differentiating aspect of Hefei’s approach seems to be aggressive efforts to woo particular companies and take direct ownership stakes, which usually is premised on that company making a significant investment in Hefei, followed by the government selling its stake at a later time (sometimes quite fast, in 3 years or so)— the company’s production in Hefei remains, and the government has expanded capital to re-invest in future projects.” The investments of Hefei’s funds are extremely targeted, often for the express purpose of helping companies set up specific manufacturing lines for specific products. The state-led venture capital ecosystem in Hefei comprises the entities listed above, as well as provincial platforms. Often, financing vehicles from specific economic zones where the company will set up are also part of the capital mix.

Another key element of the Hefei model is in-house government expertise. According to The Economist, Hefei’s government “created groups of firms in 12 industries, including semiconductors, EVs, quantum sciences and biotechnology. This “chain leader” system 链长制 empowers a government official who oversees big-picture planning for each industry.”7 The local government has maintained in-house expertise which enhances its ability to make good decisions about which industries to invest. There is also close contact between the city and the University of Science and Technology (中国科学技术大学) one of China’s top universities directly under the Chinese Academy of Sciences, which was relocated to Hefei in 1970 during the Cultural Revolution. The university is particularly strong in chemistry and nano-materials, with significance for many manufacturing sectors. “A cadre from the municipal agency has served as a project excavation manager at the Advanced Research Institute of USTC for 7 years. His main task is to help scientific researchers sort out patent results and connect with market demand.”8 The USTC has helped Hefei rank as one of the world’s top 20 cities in terms of scientific research output, according to an index produced by Nature in 2024.9

Guiding Funds

Many of Hefei’s guidance funds are administered under management of LGFV such as HFJT Hefei Jiantou 合肥建投 and Hefei Industrial Investment Hefei Chantou 合肥产投 to focus on specific industries.10 Some notable ones include: The 合肥芯屏产业投资基金 Hefei Xinping Industrial Investment Fund or the “Chip Screen Fund” set up in 2016 to invest in strategic industries, focusing on semiconductors and screen displays. The 合肥瀚和投资合伙企业 Hefei Hanhe Investment Partnership is a joint operation between the HFJTJT and Anhui Province. Other funds include Jianxiang Fund 建翔基金, and Xincheng Fund 鑫城基金 (of the Hi-Tech Zone Admin Committee).

Case 1: LCD Screens and BOE Group

In the early 2000s, Hefei had already established itself as a home appliance manufacturing center, with factories of Midea, Hitachi, and Gree (格力). However, the reliance on Japanese and Korean companies for screens was preventing the city from moving up the value chain. In 2008, Hefei's government spent US$3.5 billion for a controlling stake in BOE, a Beijing-based LCD screen manufacturer. In 2008, the Hefei government and BOE signed a 6th generation TFT-LCD production line project investment framework agreement. In this arrangement, Hefei Construction Investment, Hefei Xincheng, and BOE all put up equity in BOE’s Hefei subsidiary (See diagram below). In China, most corporations have myriad subsidiaries, like BOE, which allows local subsidiaries such as the one in Hefei to take on capital from the local government, while the main corporate entity remained in Beijing. After three years, the government began to withdraw its capital, booking a profit of 700 million yuan.11 Today, the Hefei Jianxiang Investment Co. only owns a bit more than 1% of BOE—mostly it is controlled by Beijing’s state assets supervision group. BOE’s Hefei factories are within the Xinzhan Hi-Tech Area, 新站高新技术产业开发区 (see image and map below).

The Industry Chain for Optoelectronics

Many of the input industries needed for LCD screens have linkages to semiconductor production. For example, Vital Thin Film produces ceramic components that are used in both semiconductors, displays, and photovoltaics. First of all, semiconductors are needed for screens. This includes logic chips to process the signals and data that are displayed on the screen, memory chips, driver ICs to control pixels and display images, and other specialized chips related to display brightness and sensitivity.

Corning branch of American company specializing in glass, ceramics, and related materials and technologies including advanced optics,

Visionox: primarily manufactures organic light-emitting diode (OLED) displays. They produce both PMOLED and AMOLED displays, including those for wearable devices, smartphones, laptops, tablets, and automobiles.

Sunnypol: “Sanlipu Optoelectronics mainly engages in the production and sales of polarizers, protective films, solar films, and optical films; research and development, and sales of optoelectronic materials.” (Qichacha)

See Ya high-tech enterprise specializing in the research and development, design, production, and sale of OLEDoS displays

Nexchip A pure play semiconductor foundry, China’s third largest—a joint venture with Taiwanese company.

Vital Thin Film VTFM’s product portfolio includes high purity metals, complex metal alloys, precious metals and ceramics for Display, Photovoltaic, Semiconductor, Optics, LED, Data Storage and Glass applications.

Supermask 合肥清溢光电有限公司 R&D for design, production and sales of masks. It is one of the earliest and largest mask manufacturers in China, products used for: flat panel display, semiconductor chip, touch, circuit board and other industries.

Keep reading with a 7-day free trial

Subscribe to Sinocities to keep reading this post and get 7 days of free access to the full post archives.