Inside China's Connected Vehicle-Road-Cloud Integration for Autonomous Vehicles

China's approach to testing and trialing AVs has relied on close integration of cloud computing, local infrastructure, precision maps. But is it scalable?

On Monday the Biden administration proposed a sweeping ban on Chinese “connected vehicle” cloud technology.1 American EV companies like Tesla also have their own connected vehicle software—allowing cars to be unlocked or monitored by drivers remotely, or enabling autonomous driving capability, or even connecting to third party providers like Dimo.2 But China has pursued a much more comprehensive approach to autonomous vehicle deployment for quite some time known as “vehicle-road-cloud integration” or in Chinese che lu yun yitihua 车路云一体化. 3

What exactly is the technology and why does it matter? In this post, I will explain China’s unique approach to autonomous vehicle deployment, much of which centers on the use of “connected vehicle” technology. The common assumption in the U.S. is that its all about surveillance. And while this factor can’t be totally discounted, there are other reasons why China has adopted this approach. In the following article I discuss China’s “connected vehicle” approach through the case of Yizhuang in Beijing. However, to be clear this is a separate aspect from the issue of Chinese connected vehicle technology for cars operating outside the country.

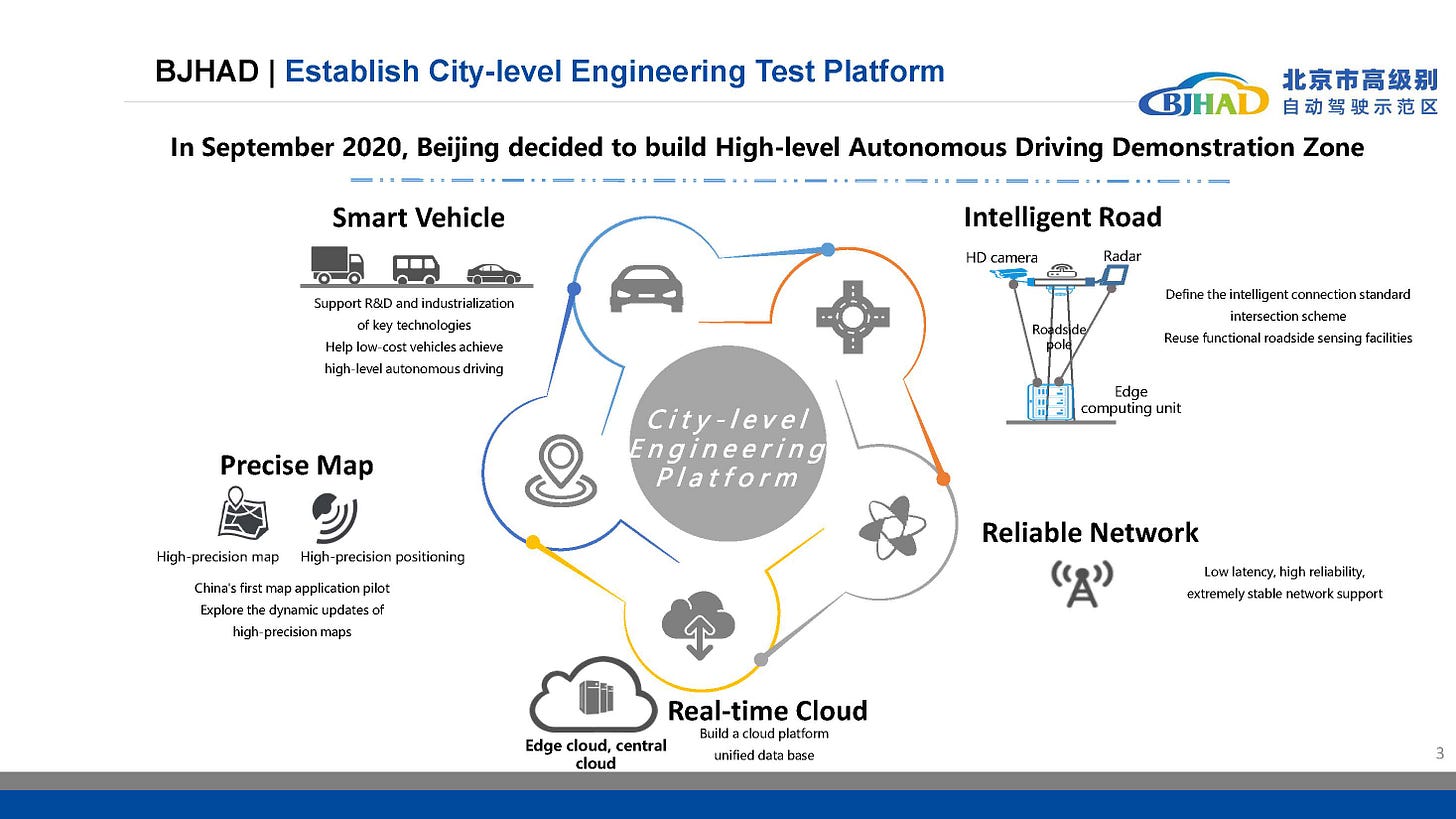

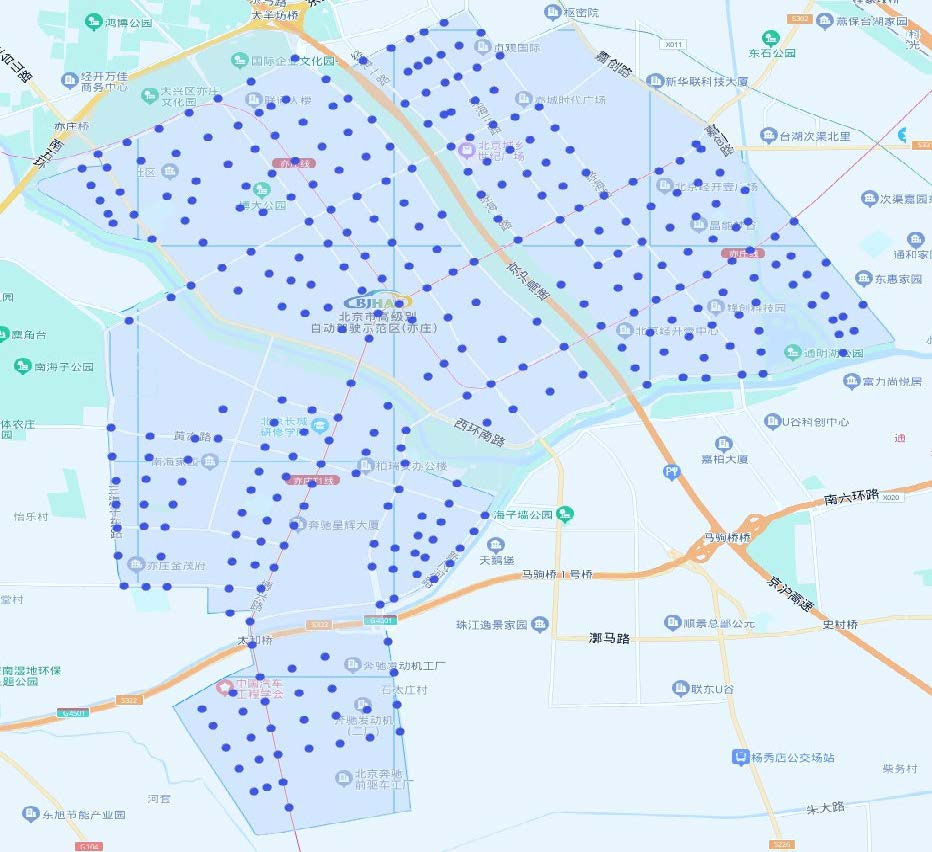

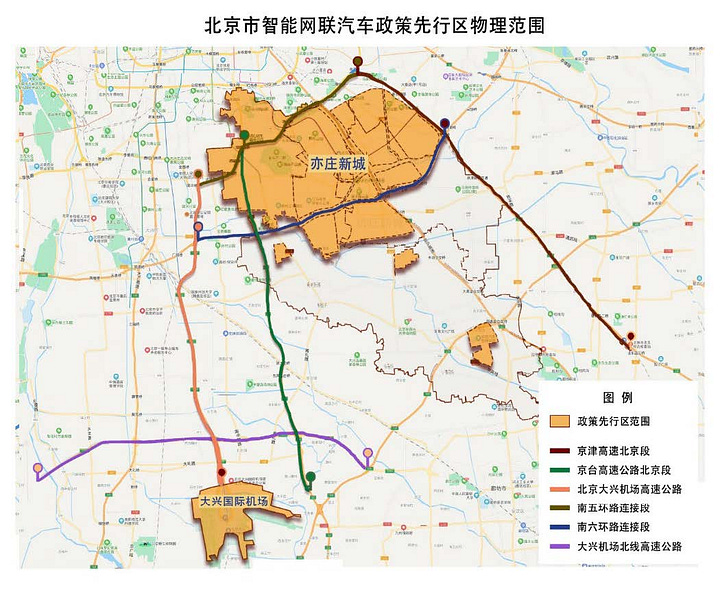

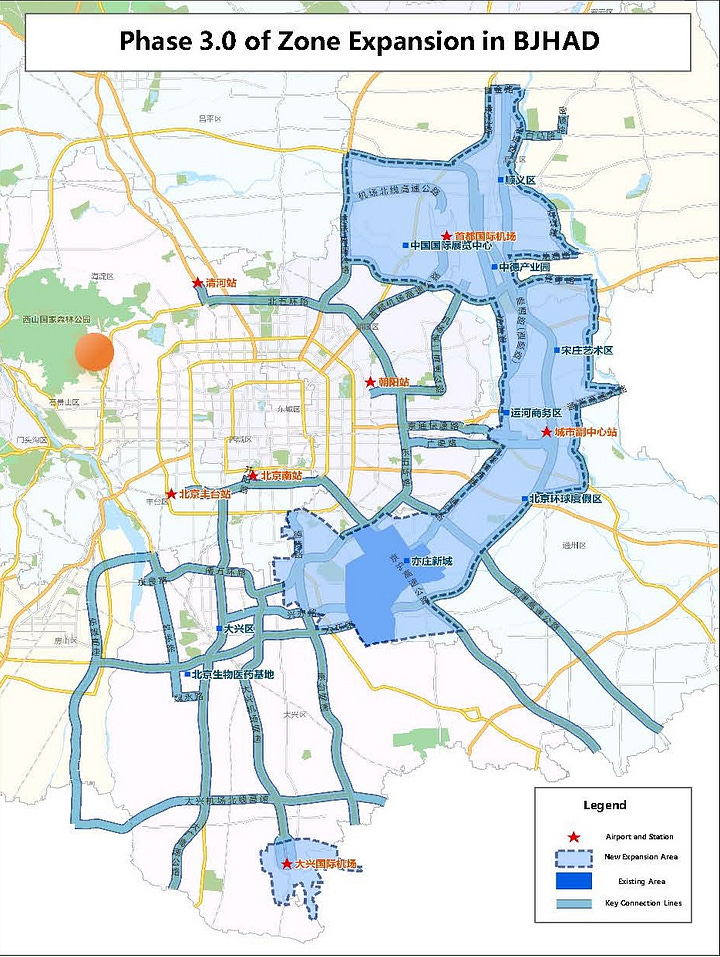

This summer, I visited the Beijing High-level Autonomous Driving Demonstration Zone 北京市高级别自动驾驶示范区 in Yizhuang 亦庄区 , a district on the SW outskirts of the Chinese capital. The area was approved as a pilot zone for connected vehicle deployment in September 2020, along with 17 pilot zones including in cities such as Chongqing, Nanjing, Ordos, Shanghai’s Jiading Changsha, and Wuxi. The Yizhuang project is a partnership primarily with Baidu, but the zone has other AV companies operating—chief among them WeRide and U.S. investor-backed Pony.ai. Administratively, the project is under supervision of a working group directly under Beijing Mayor. There are 500+ autonomous vehicles and over 1000 autonomous micro vehicles. Yizhuang was the first pilot zone where such small autonomous delivery vehicles were approved for license to drive on roads.The development of Yizhuang 1.0 (2020) comprised 28 intersections equipped with intelligent infrastructure. Phase 2 was for 304 intersections. Phase 3.0 has finished the procurement process for 700 intersections.

C-V2X Road-Cloud-Vehicle Technology

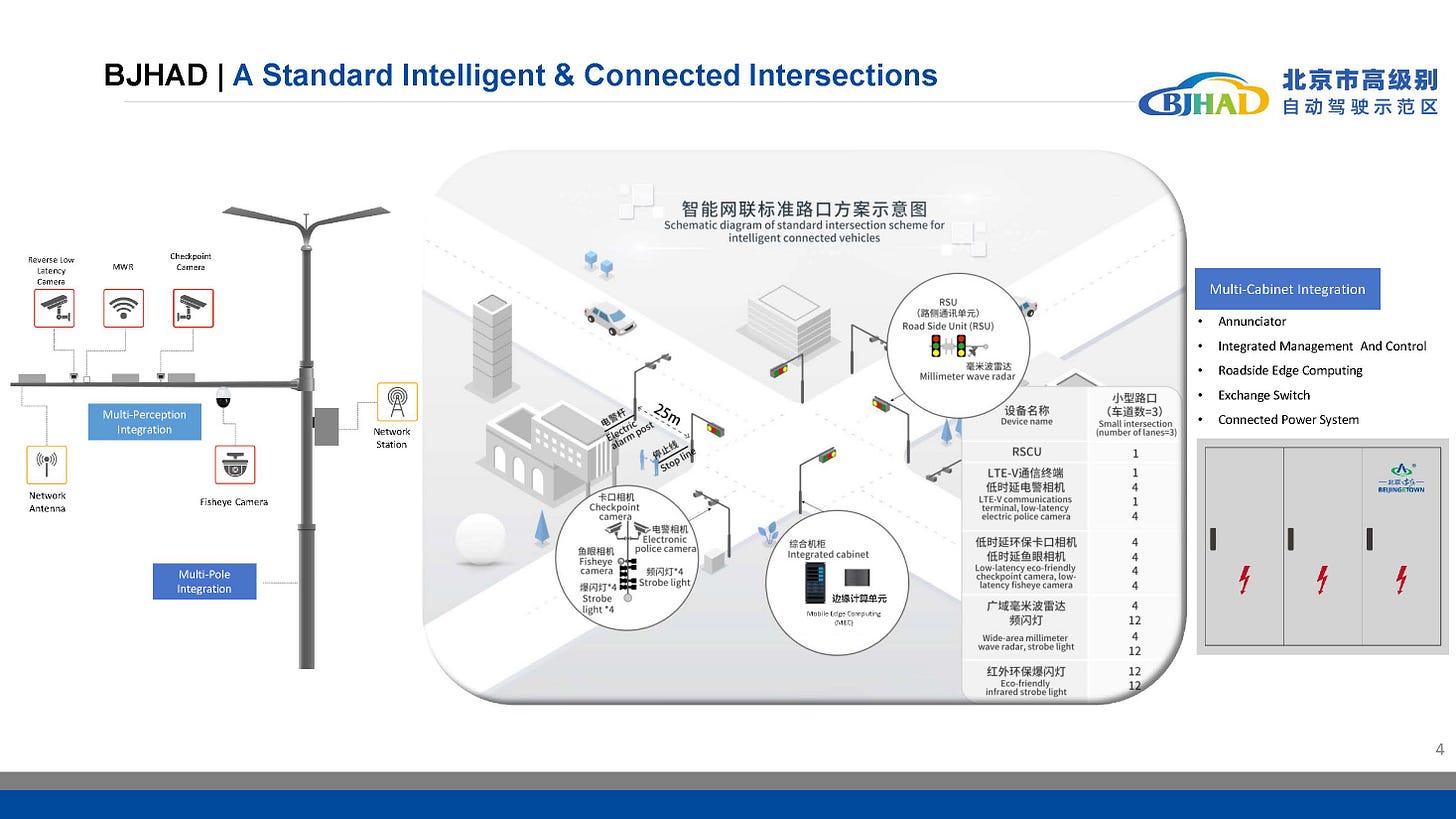

The technological set up is also referred to as V2X, the special wavelength set up for cars to communicate with roadside infrastructure, which typically comprises intelligent (AI-enabled) cameras (latency within 200 milliseconds (70 milliseconds is a human reaction time), and edge computing stations also located on the ground near each intersection. There are actual safety reasons why the V2X might make sense. For example, say a car is approaching an intersection. There is a large 18-wheeler truck blocking the approaching car’s view of the intersection. In a car-independent approach, the sensors and cameras on the car don’t see around this obstruction. In a connected vehicle approach, the car communicates with the intersection sensors when it comes within 150-200 m of the intersection—the cameras on the intersection detect oncoming traffic (outside the range of sight of the approaching car) and alert the car in advance, smoothing the breaking curve, which can help reduce traffic accidents caused by AV sudden breaking, a common cause of AV accidents. In Yizhuang, most of the AVs aren’t actually fully autonomous. The one my friend called for me as I left the area had a safety driver sitting in the driver’s seat, on board to jump in should their be a safety incident.

Yizhuang Pilot Zone

The Yizhuang Pilot Zone was set up with political backing of former Beijing Mayor Chen Jining 陈吉宁 (who is now Mayor of Shanghai and seen by some as a possible successor to Xi). The head of the district’s working office is the district boss of Yizhuang but technically the Mayor of Beijing oversees the working group with oversight of the project. The logic of the project is that it allows the district government to claim tax revenue and economic growth by recording investment of Baidu and other car companies who set up here. The city purchased 4亿 (400 million RMB) of equipment from Baidu in the first phase. But the management and ownership of data is firmly in the hands of four government-owned companies (under the district government) that were set up to manage the project: Beijing Chewang 北京车网 (data platform company), shujijian 亦庄智能院旗下北京亦庄数字基础设施发展有限公司 (in charge of building infrastructure like the telephone poles), Beijing Smart City Network Co., Ltd. (京智网) a company partially under Beijing’s Metro, and Guoji Zhitu 国际之图 a company managing the high-precision mapping platform (that apparently isn’t utilized much in the project). Beijing gave Baidu 10亿 (1 billion RMB) in overall subsidies. “The politicians have been very successful attracting investment here to Yizhuang.” Baidu AV rival Pony.ai has their North China HQ in the area.

According to the Baidu employee, the arrangement can be seen as a form of industrial policy in which the local government provides a subsidy to Baidu by buying their software and hardware equipment, and the local government gets additional high-quality data and new camera equipment, and gets to count the investment of Baidu in the district as part of their GDP and growth technologies. The local government can’t directly procure self driving cars but they can procure Baidu software to build out local digital infrastructure. Additionally, such connected cloud projects are considered as “new type infrastructure” or 新基建 and are now eligible for tax breaks and subsidies that traditional infrastructure is no longer eligible for in the current atmosphere of severely constrained local budgets.

The data sharing agreement between Baidu and the city required a unique exception to normal laws requiring strict sequestration of data collected and used by the public security bureau. “Technically this project was illegal at the time. It required an exception to allow data from camera feeds to be split at the source—one cable going into the police department, the other going into Baidu’s driving platform. Usually you would have had to have two separate sets of cameras. There’s already a lot of cameras on the intersections in the district. This saved money— to provide double of each camera would double the cost.” The police use a separate securely walled network, making the split necessary. Without the support of Former Mayor Chen Jining the project wouldn’t have been possible.

Policy Background

In Dec 2018, the Ministry of Industry and Information Technology (MIIT) issued the “Action Plan for the Development of the Connected Vehicle (Intelligent Connected Vehicle) Industry,” which established the intelligent connected vehicle program based on C-V2X for integrated vehicle-road-cloud systems. In November 2020, the General Office of the State Council issued the "New Energy Vehicle Industry Development Plan (2021-2035)" (国办发 [2020] No. 39), proposing to promote efficient collaboration of "people-vehicle-road-cloud" with data as the link, and carry out application demonstrations in specific scenarios, regions and roads; support urban unmanned driving logistics distribution, municipal sanitation, bus rapid transit (BRT), automatic valet parking and specific scenario application demonstrations based on intelligent connected vehicles.In July 2021, the Ministry of Industry and Information Technology, the Ministry of Public Security, and the Ministry of Transport jointly issued the "Management Specifications for Road Testing and Demonstration Application of Intelligent Connected Vehicles (Trial)". One of the most influential proponents of this approach has been the Tsinghua engineering Professor Li Keqiang 李克强 (same name as the deceased former Vice President of China). He has access and influence to provincial and city leaders across China. “Li Keqiang has been a big proponent of this approach,” the former Baidu employee told me. “He is doing a lot of consulting projects with various cities.” Li has been the first scientists expert of the National Innovation Center of Intelligent and Connected Vehicles 国家职能网联汽车创新中心, and Head of the National Ministry of Industry and Information Technology's Intelligent Connected Vehicle Promotion Expert Group (国家工信部智能网联汽车推进专家组). There is also the role of the influential 中国汽车工程学会 Chinese Society of Autonomous Vehicles.

Monetizing Data

There is some thinking the connected vehicle approach can be monetized by selling data—either to automakers. Ford paid Baidu for traffic light data that belongs to government, but Ford has to use a China-based map and data for their vehicles in China. The cloud company managing the data could also sell it to other companies or other government agencies.

Challenges of C-V2X Approach

Even as the “connected vehicle” approach has been chosen as a key direction for China’s AV deployment, there are significant obstacles with this approach. Chief among is these are the issues of scalability and infrastructure maintenance costs.

“Most automakers are very hesitant to participate in any of this, most companies have participated have received direct funding from Yizhuang, but not the general auto industry; most automakers (i.e. Lixiang, Weilai) they don’t want their investors to know that their AVs depend on anything other than the roadside; they tell their investors its smart enough to drive on their own.”

Around the same time as I visited Yizhuang, English media were also reporting on the widespread deployment of autonomous vehicles in the city of Wuhan, which earlier this year went ahead with a citywide deployment of AV technology primarily with Baidu’s Apollo Go (Luobo) subsidiary. Interestingly, Wuhan wasn’t one of the pilot “connected vehicle” cities in the 2021 plan. Why had Wuhan gone ahead while Beijing and other cities were still testing AVs only in delimited zones?

“One obstacle in Beijing is that within the 5th ring road is an extremely sensitive area for government ministries, so the high-precision maps that are necessary to be shared with AV companies to make this work are not currently feasible within Beijing’s 5th ring. This essentially means AV experiments will be limited to the city’s peripheral areas, significantly hindering their usefulness to passengers and preventing citywide deployment. Nonetheless, there are no signs China as a whole is fully abandoning the connected vehicle approach.

“I’m pretty convinced, most of the safety problems of AVs can be solved by better road design.” a friend working in urban design in China tells me. Of course, the master planning for Yizhuang was done many years before the opening the the AV test pilot zone. The roads are wide, a dangerous feature for pedestrians, leading to increased risk of pedestrian injury—both with AVs and with normal traffic. The widespread deployment of AVs in Wuhan has been met with criticism from some, as slow driving and sudden breaking AVs disrupt traffic. 4 Could a connected approach help solve these issues? Even if safety incidents are rare, they could spark public backlash and risk disrupting AV uptake by consumers. This could increase public support for a connected vehicle approach.

Whether or not China’s connected vehicle-cloud-road technology is scalable or not, there are few signs China is abandoning this approach. While the Yizhuang Pilot and China’s C-V2X are not directly affected by U.S. sanctions (which aimed to ban use of connected vehicle tech in the U.S.), this article has aimed to show that China’s connected vehicle technology is not merely about surveillance.5 Rather, the logic behind it is highly specific to China’s domestic political economy—namely the way in which local governments need to generate economic growth (increasingly now in advanced “high quality” sectors ). The power of local public security bureaus is also a factor, related of course to surveillance. But the larger system illustrated in Yizhuang is the provision of digital infrastructure is a form of industrial policy to attract investment in the AV industry in specific places. The export of Chinese EVs and AVs to the U.S. is currently blocked by ongoing U.S-China trade tensions, and U.S. plans to slap hefty tariffs on Chinese vehicles.

https://www.nytimes.com/2024/09/23/us/politics/chinese-software-ban-cars-biden.html

https://www.tesla.com/support/connectivity; https://www.forbes.com/sites/jamesmorris/2022/03/12/connected-cars-are-just-as-revolutionary-as-electric-vehicles/

https://dimo.co/blogs/the-pit-stop/tesla-enables-direct-integration-with-popular-connected-car-app-dimo

It should be noted the ban proposed in the U.S. is more general, whereas this article focuses on specific projects of cloud-vehicle-road integration WITHIN China. But some elements of this connected approach could be exported abroad, albeit in a modified form.

https://www.sixthtone.com/news/1015505; https://www.cnn.com/2024/07/18/cars/china-baidu-apollo-go-robotaxi-anxiety-intl-hnk/index.html

NVIDIA and Baidu inked a deal to provide state of the art NVIDIA chips in 2017, but now Baidu is on the U.S. entity list and must turn increasingly to domestic chip manufacturers. https://nvidianews.nvidia.com/news/nvidia-baidu-announce-partnership-to-accelerate-ai

https://www.tomshardware.com/tech-industry/artificial-intelligence/baidu-admits-us-sanctions-on-nvidia-and-amd-gpus-mean-it-might-not-have-access-to-leading-edge-gpus-again