Mapping China's inland data centers

A national vision, China's East Data West Compute 东数西算 is a series of local infrastructure projects involving data centers, new energy infrastructures, and new digital industry clusters.

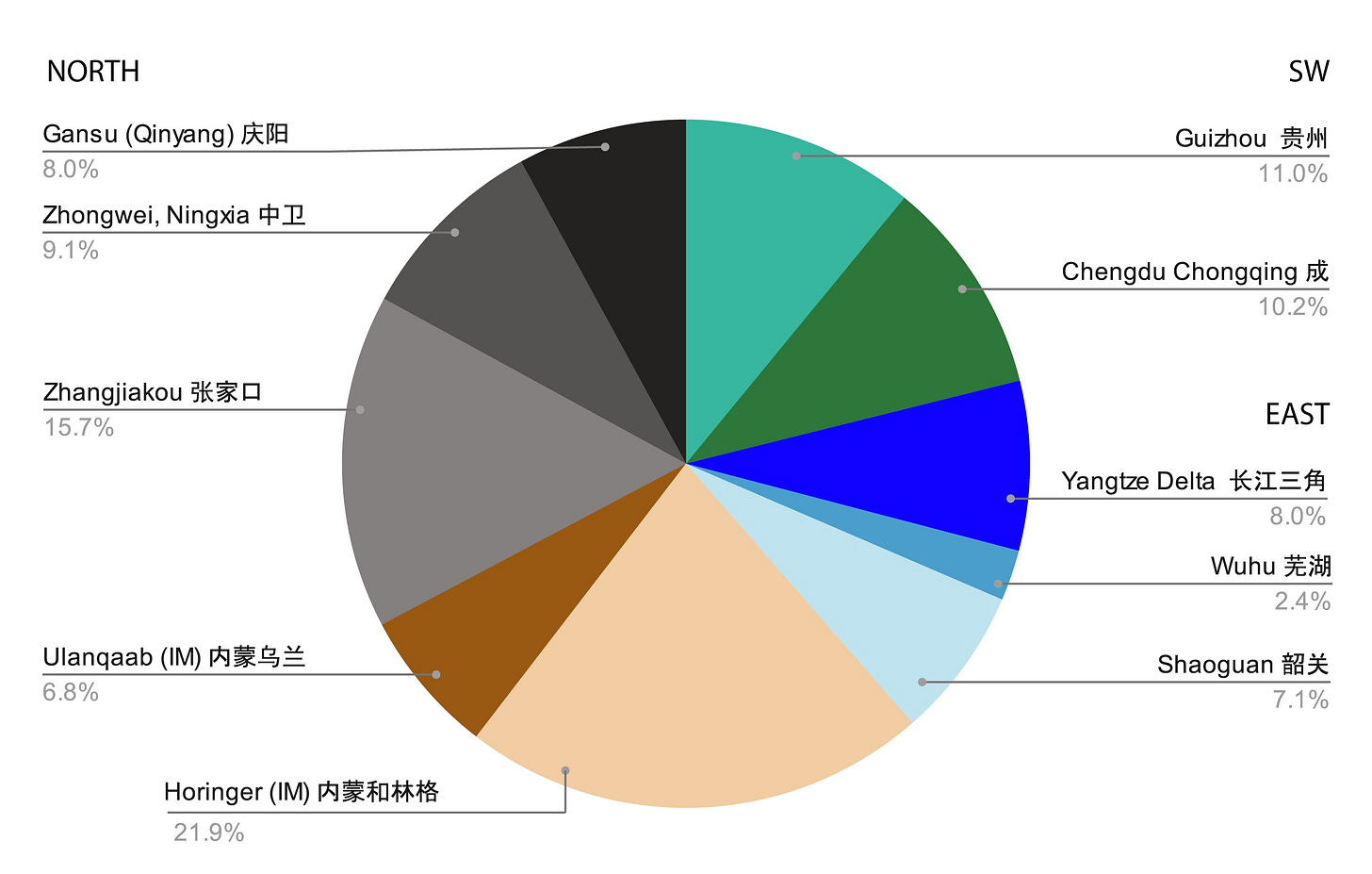

China’s existing data centers are, like data centers in most parts of the world, located in or around major metropolitan areas. In the case of China, most of these (but not all) are on the Eastern seaboard—the three megapolitan regions of Pearl River Delta (Guanzhou-Shenzhen), Yangtze River Delta (Shanghai-Suzhou-Wuxi-Changzhou-Hangzhou), and Jing-jin Ji (Beijing-Tianjin). The Eastern Data Western Compute Plan otherwise known as Dongshu Xisuan 东数西算 calls for optimizing the country’s cloud computing infrastructure by channelling investment across 10 data center hubs (essentially regions) broken down into 10 data center clusters—specific areas where data centers will be built. Some of these clusters are located fairly close to existing urban areas (Zhangjiakou near Beijing, Shanghai’s new Yangtze River Integrated Development Zone in Qingpu, Shaoguan north of Guangzhou, and Chengdu’s Tianfu New Area). Others are more remote: Ulanqaab and Horinger in Inner Mongolia, Zhongwei in Ningxia, Qinyang in Gansu, and Gui’an New Area in Guizhou. Among these, Guizhou was among the first to develop, beginning in 2013, followed by Hohhot and Inner Mongolia’s provincial big data plan in 2016. Zhangjiakou also developed early on with investments of Alibaba. But the 2021 EWDC plan has scaled up investment in these emerging hubs and also led to new ones such as Qinyang and Zhongwei further West.

In this article, I take a look both at the overall picture of the East Data-West Compute Plan, as well as zoom into a few clusters to examine the planning of data center industrial districts and the associated infrastructures required to support them—power substations, new renewable energy (solar and wind arrays), and new traditional power stations. Data centers consume huge amounts of energy, and in China local governments and national power companies have set about developing new energy infrastructures to support some of this investment.

The planned scale of expected investment is 4000亿 (400 billion RMB, or $55bn USD. According to announcements of “total investment” of planned data centers in the hubs, almost 75% of that figure has already been reached.1 Of course, not all of that investment has materialized yet, but this includes projects planned and already announced, albeit some of those have not yet broken ground.

Before people start interpreting this article as suggesting impending Chinese dominance of cloud computing, it’s worth noting that the U.S. remains the leader in cloud computing data centers (and cloud market share) by a wide margin. There are over 5,300 cloud centers in the U.S, and China brings up second place with around 400—although this number is likely higher, perhaps around 700 depending in if you count hyperscale data centers or just any small or medium sized center.2 China’s massive investment will undoubtedly chip away at the gap. But the U.S. is also engaged in efforts to develop cloud computing centers. So far, most of the U.S. cloud computing industry has been privately financed, led by cloud companies like Amazon Web Services, Microsoft Azure, Google, and others. Microsoft just announced plans to restart Three Mile Island Nuclear Plant to support data center construction, revealing the massive energy requirements of new data center infrastructure.3

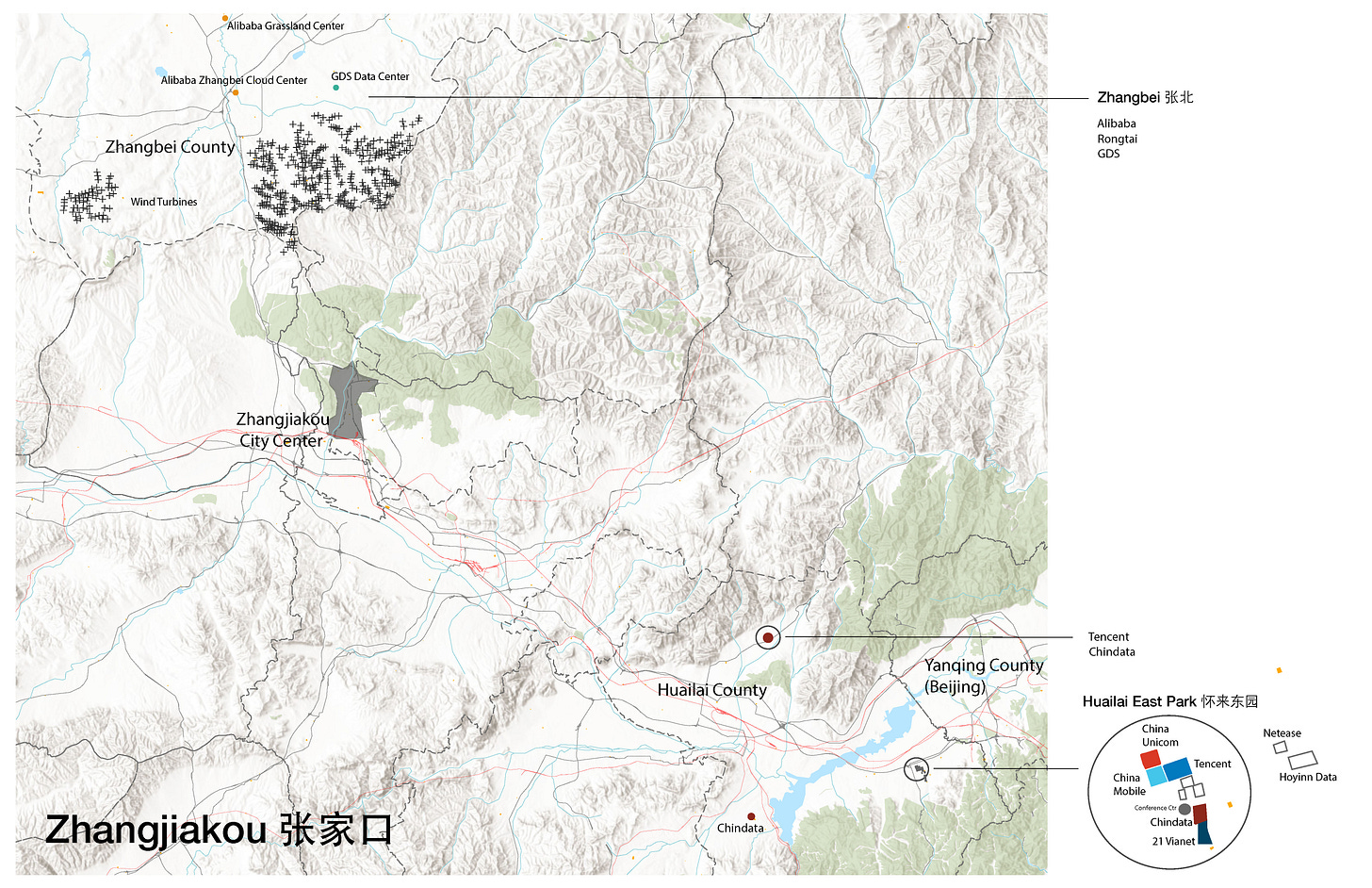

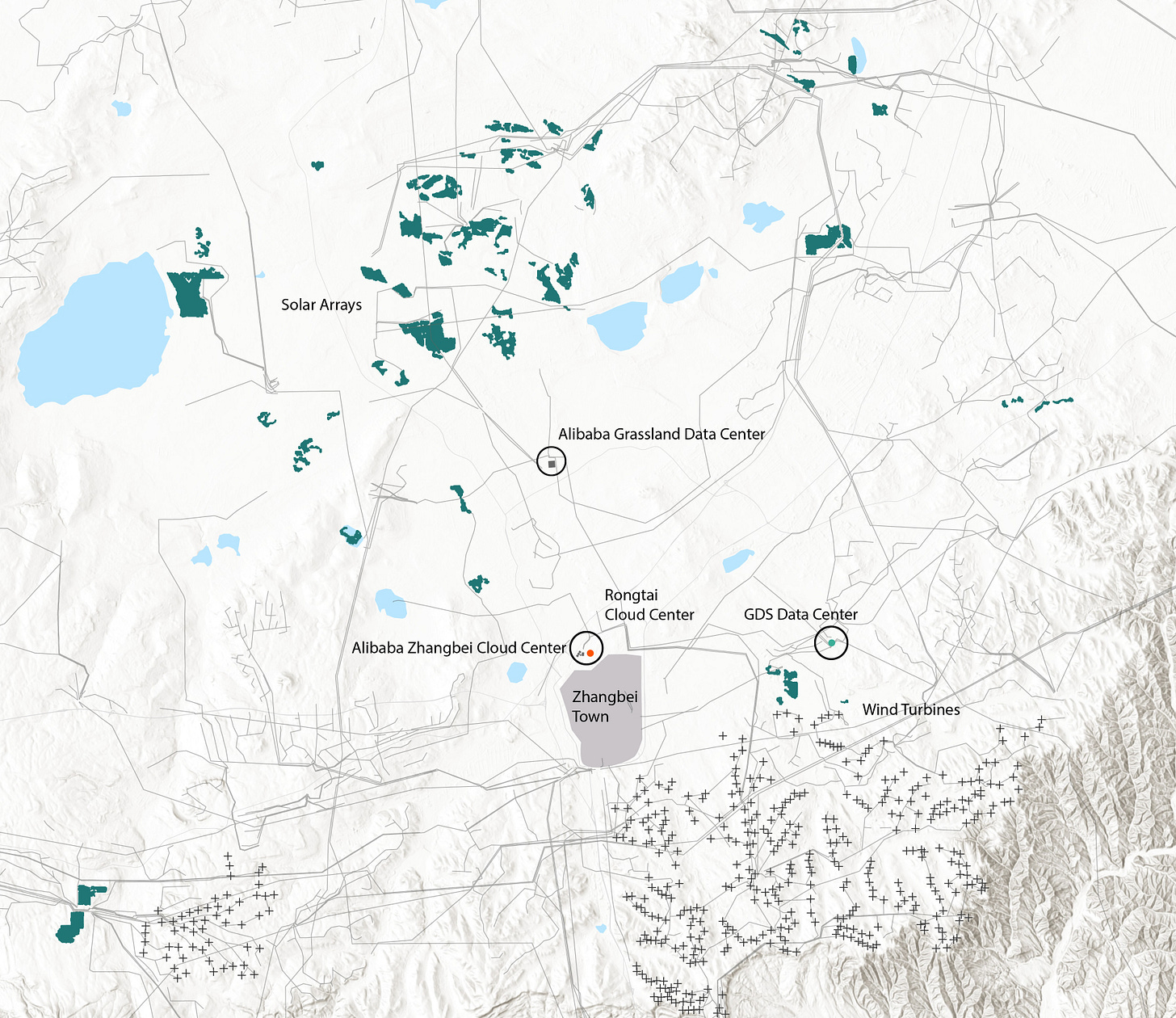

Zhangjiakou 张家口

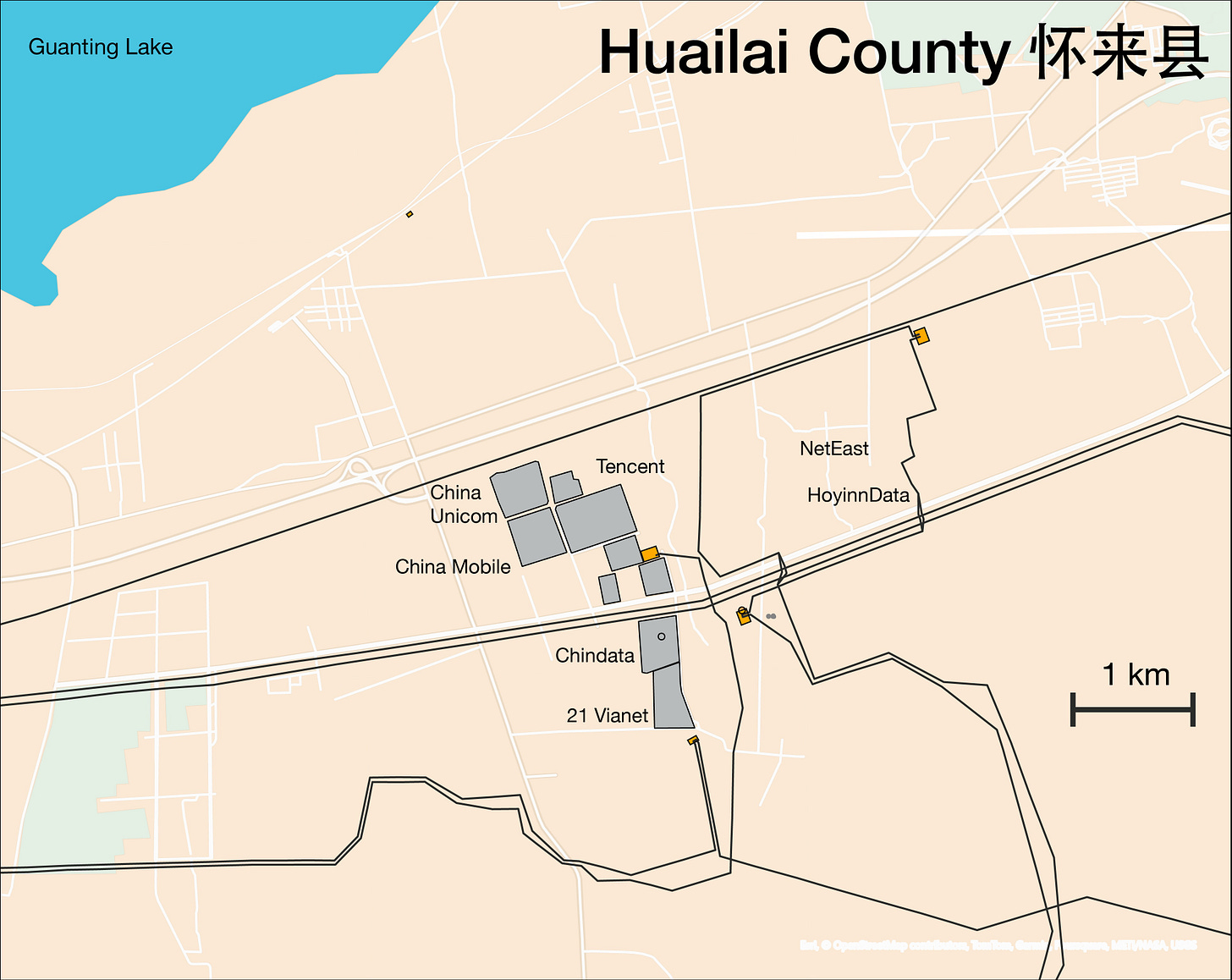

Lying just Northwest of Beijing, Zhangjiakou is a sprawling prefecture-level city in Hebei that is quickly becoming a data center hub. Alibaba opened a large facility in Zhangbei County 张北县 at the Northern end of the area in 2016. This county (see second image) has facilitated the construction of wind turbines and solar panel arrays in the vicinity of the data centers, which also include a facility by GDS 万国数据. The other main cluster in Zhangjiakou is the county of Hualai 怀来县, located to the south and just across the border from Beijing. This cluster is fast developing, already hosting major data centers of Tencent, Chindata 秦淮数据, and new data centers under construction by China Mobile, China Unicom, 21 Vianet, and additional facilities of Chindata. Due to its proximity to Beijing, Zhangjiakou makes a lot of sense from a private market perspective as well as the national strategy—hence Alibaba’s early investment in the area. Chindata has also become a major partner, signing a 10 yr cooperation agreement with Zhangjiakou Urban Investment Corporation in 2022 around the time of the winter olympics—many of the events were hosted by Zhangjiakou.

Gui’An New Area

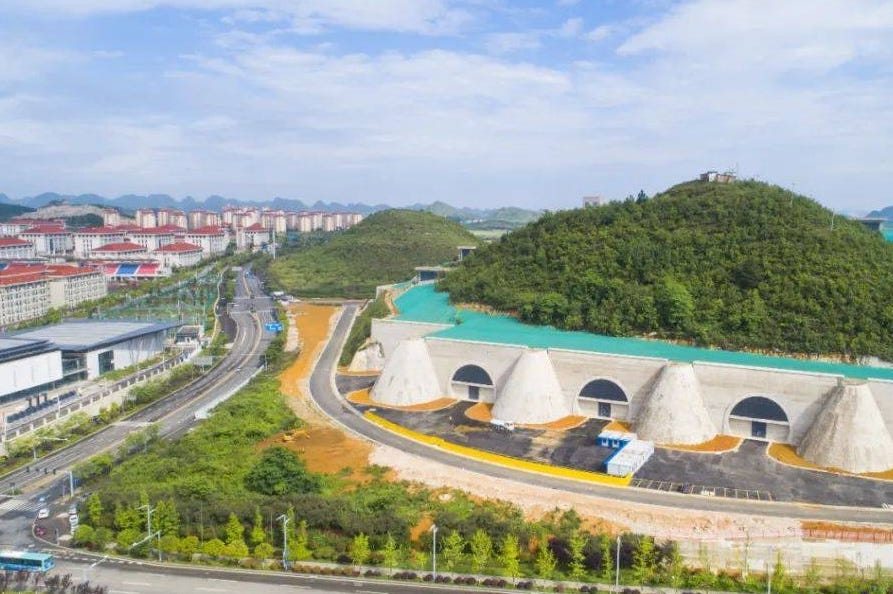

Guizhou started its efforts to attract big data centers back in 2013 as part of the creation of the Gui’an New Area (China’s 18th national level new area). The area was supported with strong national-level backing.

Tencent (pictured) and Huawei both opened large data centers here, as well as Apple’s first China data center to host data for its China-based users in compliance with China’s 2017 Cybersecurity Law that mandated local data requirements for foreign companies with Chinese users.

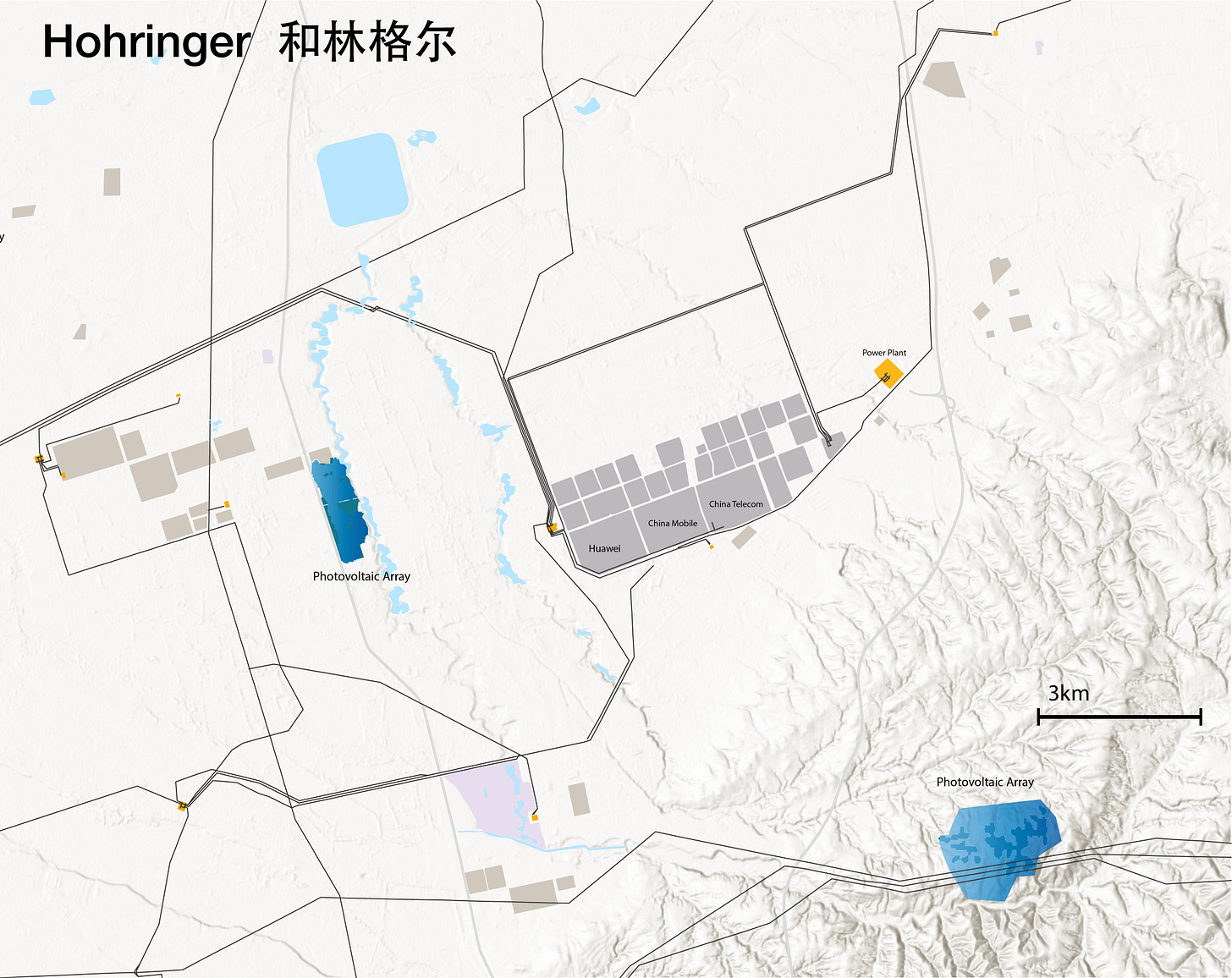

Hohhot (Horinger)

China Telecom began work in 2011 a data center just south of the Inner Mongolian capital of Hohhot—the county of Horinger 和林格尔县 . In 2016, Inner Mongolia unveiled a provincial strategy on big data aiming to replicate Guizhou’s efforts in Northern China. Inner Mongolia, with ample renewable energy potential in solar and win, as well as favorable cool and dry climate for data centers, is thus an ideal location for data center construction. The area is being branded as China Cloud Valley and is actually part of a broader plan for a new area that aims to draw digital industries beyond data centers. China Mobile has opened a massive facility near China Telecom. New planned data centers for national banks (Bank of China, Agricultural Bank of China, China Construction Bank) are also planned here, as well as facilities of U-Cloud and Huawei. So far, the data centers were the first to open.

Ulanqaab 乌兰察布

Ulanqaab (or Wulanchabu in pinyin) is a prefecture-level city in Inner Mongolia, located about halfway between Hohhot and Zhangjiakou. It’s a <2hr high speed ride to Beijing. Ulanqaab’s Grassland Big Data Valley has already attracted Apple’s second data center in China, as well as data centers of Huawei, Kuaishou, U-Cloud, and ZData. Ulanqaab seems to have attracted more private investment than Hohhot, which appears to be more focused on state-backed telecoms and national banks.

Scope of Investment by Operator

Other Data Clusters

The following clusters are emerging but have also received significant investment. A later report will delve into these, but in general these areas do not yet have as significant a cluster of cloud computing centers as the ones mentioned above.

Chengdu-Chongqing. The Chengdu-Chongqing region is one of China’s major urban megaregions. The two clusters within this region are Chengdu’s Tianfu New Area 天府新区 and Chongqing—which are spread across several districts of the megacity.

Shaoguan (Guangdong Province) is located just north of Guangzhou, and is meant to supplement data centers for the Pearl River Delta region.

Wuhu (Anhui Province). This prefecture-level city in Anhui is being developed into a data center cluster for the Yangtze River Delta. One of the digital industrial parks in Wuhu is China vision valley 中国视谷, which is apparently focusing on data centers related to online games, animation, film and television.

Qinyang (Gansu Province) Located NW of Xi’an in far western Gansu, the remote city on the Loess plateau Qinyang has ambitious plans to develop as a data center cluster. Qinyang has attracted investment of Kingsoft Cloud, a cloud company owned by Xiaomi and listed in the U.S. in addition to planned data centers of Huawei and big three telecoms. So far, Qinyang is one of the smaller clusters.

Zhongwei (Ningxia Province) Western Ningxia province has been one of the smaller and slower clusters to develop. Most of the announced data centers here are those of the big three state telecoms.

Shanxi Province 山西省

Shanxi province is not officially listed among the 10 cloud computing clusters outlined in the EWDC plan, but it has many of the same qualities that make neighboring Inner Mongolia and Hebei’s Zhangjiakou ideal data centers. Located on a plateau, with cooler and drier summers, Shanxi has similar climate conditions. It is also directly West and fairly close to Hebei Province and the Beijing-Tianjin Hebei area.

The Beijing-based Chindata 秦淮数据 has been one of the largest investors and operators data centers in the province, particularly near Datong. It opened a massive facility (pictured below). Chindata makes a majority of its revenue from Bytedance (which owns Tiktok in the U.S.)

Stokols, Andrew. “China East Data West Compute Project.” Harvard Dataverse, 2024. https://doi.org/10.7910/DVN/QMMPZD.; these figures are based on scraping of news reports and corporate announcements of planned and opened data centers.

https://www.statista.com/statistics/1228433/data-centers-worldwide-by-country/

https://www.technologyreview.com/2024/09/26/1104516/three-mile-island-microsoft/